Analysis of Latest Tungsten Market from Chinatungsten Online

Recently, the international financial market has shown a highly consistent optimism regarding the future trend of gold, with major institutions raising their target prices. OCBC Bank raised its target price for gold to USD 5,600/oz, believing that gold is transforming from a traditional crisis hedging tool into a neutral and reliable store of value. DBS Bank set its target price for the second half of 2026 at USD 5,100/oz, Huaxi Securities predicts a 10%-35% increase, and international investment banks such as Goldman Sachs, HSBC, and JPMorgan Chase predict that gold prices will rise to the USD 5,000-5,400/oz range in 2026. These predictions are based on a nearly 70% increase in gold prices in 2025.

On January 26, 2026, international gold prices broke through the USD 5,000/oz mark for the first time, setting a new historical high, with a cumulative increase of nearly 17% since the beginning of the year.

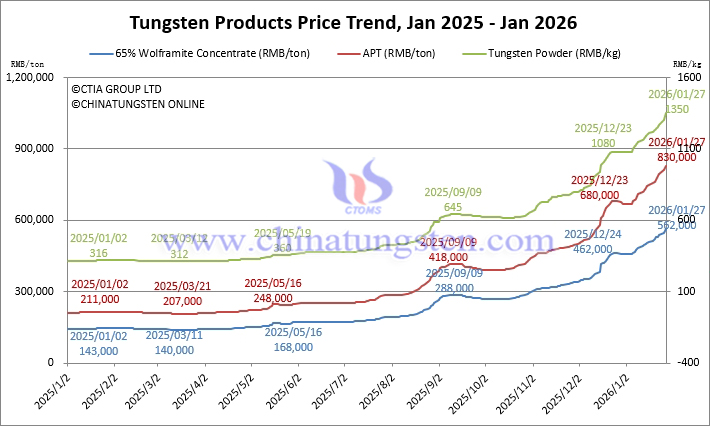

While gold attracts global attention, tungsten is creating even more astonishing market performance. In 2025, tungsten prices surged by over 220% throughout the year, outperforming the base and precious metals markets. Entering 2026, the upward momentum showed no signs of abating, with a year-to-date increase exceeding 22%. As of press time, tungsten concentrate prices have surpassed RMB 560,000/ton, ammonium paratungstate prices have reached RMB 830,000/ton, and tungsten powder prices have exceeded RMB 1.32 million/ton.

According to Chinatungsten Online, besides the tight supply situation, the fundamental driving force behind the soaring gold and tungsten prices lies in the high uncertainty of the global political and economic environment and the escalating risks of geopolitical conflicts, which have jointly boosted the demand for strategic reserves and investment in safe-haven and strategic assets. Gold, with its prominent monetary attributes, benefits from central bank gold purchases and the logic of inflation hedging. Tungsten, with its irreplaceable industrial and defense attributes, has become a core target for strategic resource revaluation. Many major economies, including the US and Europe, have listed tungsten as a key mineral and are accelerating the development of diversified supply chains to reduce their dependence on Chinese tungsten products, which hold 80% of the global market share.

It is worth noting that as the Spring Festival approaches, tungsten market trading activities are increasingly affected by the pressure of high prices and the holiday atmosphere, leading to more cautious trading and relatively limited transaction volume.

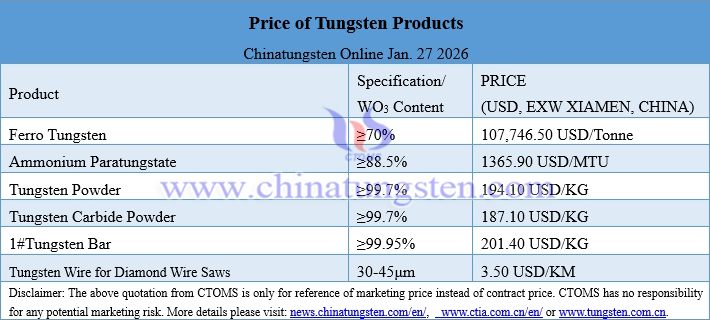

Prices of Tungsten Products on January. 27, 2026

Tungsten Price Trend from January 2025 to January 2026